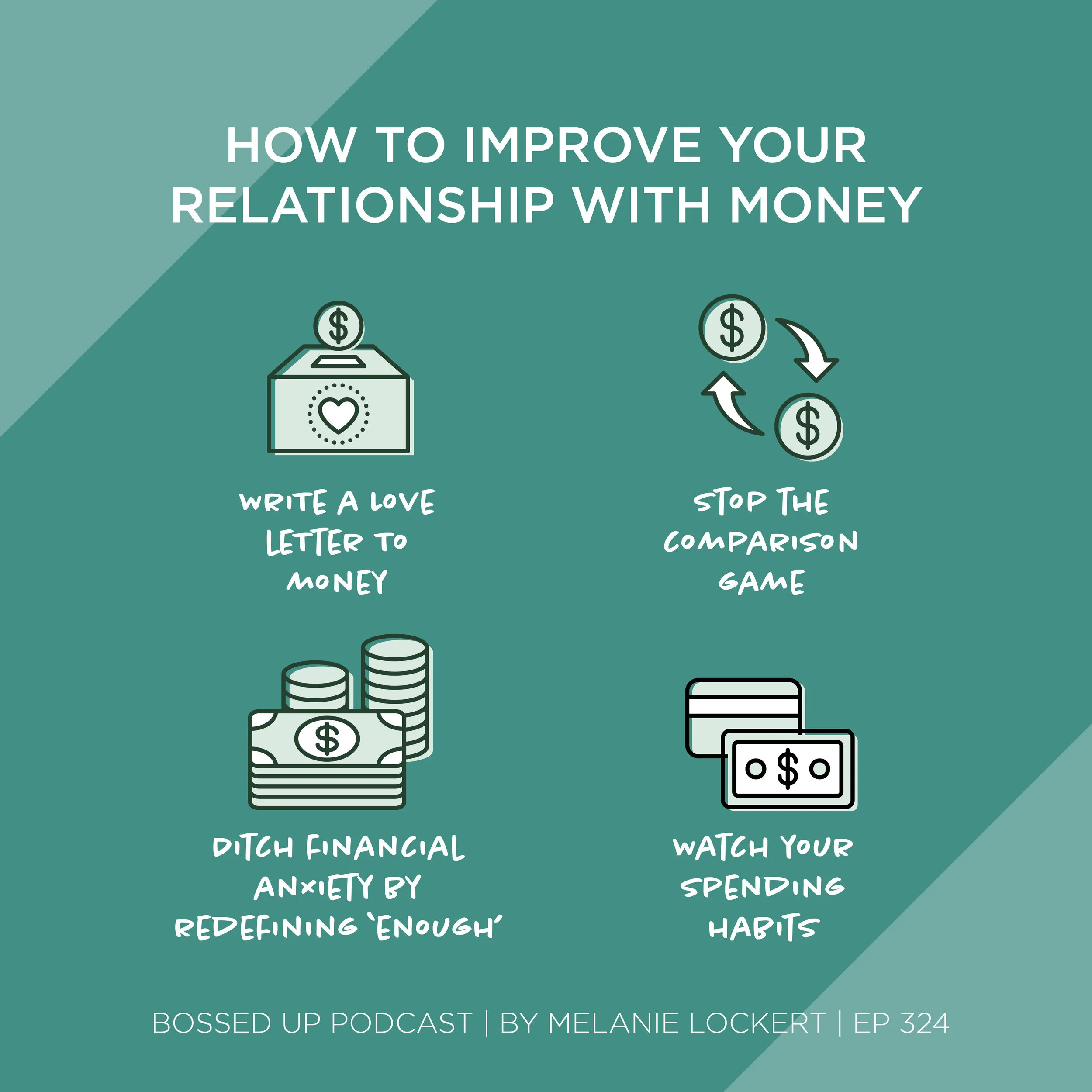

How to Improve Your Relationship with Money

Episode 324 | Author: Melanie LockertWhat’s your money mindset?

It’s Financial Literacy Month and we’ve called on our personal finance trainers to take over this month’s boss tips!

Today you’ll hear from Melanie Lockert, founder of the blog and author of the book, Dear Debt, all about how you can overcome your financial anxiety by reestablishing your relationship with money.

A few years ago, I started my blog Dear Debt to hold myself accountable while paying off my student loans. The premise of the blog was about breaking up with debt. I’d write dear debt letters or breakup letters to debt and share how I was over our draining, toxic, and shameful relationship.

Now that it’s been five years since paying off $81,000 in debt, I’m focused on improving my relationship with money and growing my wealth. If you want to improve your relationship with money, too, here are some steps you can take.

Write a love letter to money

Instead of writing breakup letters to debt these days, I’m writing love letters to money. Oftentimes we think of money as this stressful thing that can lead to guilt, shame, or anxiety.

Many of us have a negative money mindset and have associations with money that don’t serve us. Perhaps like me, you grew up thinking rich people were greedy or that money was evil. Money is just a tool and having those thoughts is a great way to never have money or self-sabotage. I had to address these thoughts before I took action on my debt because they were keeping me stuck.

One way you can improve your relationship with money is to express your love and joy with what money actually brings you.

Anyone who’s ever been in a relationship knows that expressing gratitude or sharing a compliment can go a long way. So why not do that with your money? Take an inventory of all the things your money provides you.

For example, does money provide a roof over your head? Food to eat so you don’t go hungry? Have you used your money in a way to help others through employment, supporting their business, or through donations? Have you used money to buy back time?

Write all of these things down. Write a love letter to your money and express thanks for all it does for you right now.

Stop the comparison game

As the saying goes, “comparison is the thief of joy”. This can be especially true when the Joneses are everywhere on social media and we have opportunities to compare ourselves everywhere we turn.

The thing is we don’t know anyone’s back story. Maybe they have nice things but are deep in debt. Maybe they earn a ton of money but don’t know how to manage it. The point is that we must run our own race and not compare.

We don’t have the information to compare and it’s not fruitful. The only person to compare yourself with is your former self. Are you making the progress you want? You can track your net worth, your debt repayment progress, and your budget each month to see how you’re improving, while still running your own race. Even when you don’t meet your mark, celebrate all progress and keep your eye on the goal. The point is to keep going and keep trying despite the setbacks that arise (and they will).

Putting the focus back on ourselves and our own money can improve our relationship with money. Comparing yourself to others is a distraction. Distraction moves you away from focus. Focus on YOU and your relationship with money.

Imagine in a romantic relationship if you’d start focusing so much energy on someone else? It would start to be suspicious and your relationship would suffer.

Ditch financial anxiety by redefining ‘enough’

Anxiety can creep up when we feel we are so far away from where we’re supposed to be. Maybe we feel we don’t have enough saved or invested, we don’t earn enough or we’re just generally behind. Those feelings are valid but may not be true. In other words, you’re allowed to feel what you feel but your feelings aren’t facts.

And while ambitious women like you and me want to aspire to more and reach higher goals, it’s important to reframe our thinking to help mitigate financial anxiety.

I want you to ask yourself, “What if I already have enough?”. As Ken Honda, author of Happy Money says, “If you think you have enough money, you do.” Notice the word “think”. So much of this relates to mindset.

Given everything that has happened this past year, we’ve all been reminded to be grateful for all we do have - and it’s clear that many of us do already have enough. Can we want more and strive for more? Yes. But we can ditch that feeling of not having enough. If you can provide for yourself and have a roof over your head, food to eat, and a bed to rest, you have enough in this moment.

Watch your spending habits

I host money management check-ins and I guide people to look through their expenses over the past month and put a smiley face, sad face, or neutral face next to each expense. Sometimes we spend money mindlessly without thinking if we’re using money in a way to bring us joy.

So start by reviewing your expenses for the past month and mark how they made you feel with a smiley, sad, or neutral face. When you look at the sad and neutral faces, are those things you can cut back on or eliminate completely? What are the things that are bringing you happiness?

On top of that, you want to understand your spending triggers too. A spending trigger is a feeling, situation, or location that encourages you to spend. For example, maybe every time you pass a Starbucks you feel you have to stop in. My spending triggers are hunger and fatigue. I tend to spend carelessly when I’m exhausted or hungry and just want to improve how I feel and don’t care about money.

Now I work hard at bringing snacks with me everywhere and also prioritize sleep because I know it affects so many areas of my life, including spending.

You can do this by having a spending journal and writing down how you feel when you spend money and you may start to see some patterns. On the other hand, you may know your spending triggers instinctively and just need to take the next step to be mindful about it and create an action plan to try and avoid those triggers.

Improving your relationship with money isn’t easy and won’t happen overnight. It’s a work in progress. But the main things are to be mindful of your money, spending triggers, and redefine having enough while showing gratitude and love to your money.

If you want more information about how to improve your relationship with money, check out Dear Debt the blog or book, attend a Money Management Check-In, or listen to my podcast The Mental Health and Wealth Show.

Got a career conundrum you want Emilie to cover on the podcast? Call and leave us a voicemail NOW at 910-668-BOSS(2677).

Put your money where your heart is.